This calculator helps you work out how much you can afford to borrow. But ultimately its down to the individual lender to decide.

Five Financial Must Haves For First Time Home Buyer In Malaysia Kclau Com First Time Home Buyers First Time Home Buying

In order to calculate how much you could borrow we need to base our calculation on an interest rate.

. The interest rate youre likely to earn. Were here weekdays 800am - 800pm or Saturday 900am - 500pm to answer your home loan questions. And the current Extra Home Loan reference rate for Investment home loans is 538 pa.

To begin input. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home loan. Would like to compare the impact of different interest rates on the amount you can feasibly borrow.

In the end when making the decision to acquire a property the borrower needs to consider various factors. Hey there As per the replies earlier for loans its not just about how much you earn but also what your spending habits and outstanding debts are like. There are three parts to this calculator.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. This borrowing calculator is intended as a guide only and is based on the Residential Owner Occupied rate. You dont need to add your current rentaccommodation costs if youll be living in your new home.

This borrowing calculator does not. Annual income monthly expenses and loan details. The calculated figures are illustrative only and based on the accuracy of information entered.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. This calculator provides an estimated amount for. Subtract your expenses from your income to.

This is not an offer of finance by ANZ. You can use Canstars Home Loan Borrowing Power Calculator to estimate your borrowing power. Your monthly recurring debt.

Unsure how much you can borrow for a mortgage. So a very quick way to work out what you can afford to borrow is to. Other factors like your credit score and whether you have a guarantor can also play a role.

In this example we have used the current Residential Owner Occupied rate for our Classic home loan. Call 0800 269 4663 to talk to an ANZ Home Loan Coach Visit an ANZ branch. The Debt Service Ratio DSR is what banks usually use to decide how much you can borrow.

How much a homeowner can borrow with a home equity loan depends on how much equity is involved. Visit us at one of our many branches across New Zealand. Please note that there are temporary restrictions on our deposit requirements which may mean you will need at least a 20 deposit for an owner-occupied property.

Best Fixed for HDB is 145. If youre not sure just put an estimate. To find out more about DSR or how to calculate DSR you may refer to this article.

Get a quick estimate on how much you may be able to borrow depending on your current income and existing financial. Are assessing your financial stability ahead of purchasing a property. Its a good idea to check your credit.

The first step in buying a house is determining your budget. Divide by 12 to get a monthly repayment. Comparison rate calculated on a 150000 secured loan over a 25 year term.

It is not an offer of finance from Westpac New Zealand Limited Westpac and is not financial advice. Things you should know. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt repayments.

Calculate what you can afford and more. These factors affect your credit score. Your annual income before taxes The mortgage term youll be seeking.

Take your annual income. This affordability calculator is intended as a guide only and is based on the limited information provided by you. As part of an affordability assessment lenders will check your credit report to see how youve managed debt in the past.

This mortgage calculator will show how much you. As at 15 July 2022 Extra Home Loan reference rate for Owner Occupied home loans is 503 pa. The Maximum Mortgage Calculator is most useful if you.

Under this particular formula a person that is earning 200000 each year can afford a mortgage up to 500000. It is based on your financial situation including how much you earn your expenses your existing debts and the size of your deposit. 2022 Best Home Loans updated 10 March Variable from 090.

Work out 30 of that figure. Want to know exactly how much you can safely borrow from your mortgage lender. Here are some quick examples.

How To Borrow Airtime On Airtel In Nigeria The Borrowers Best Snapchat Borrow Money

What S The Real Difference Between Buying Private Property In Singapore And Iskandar We Ll Show You Investing Singapore Investment Property

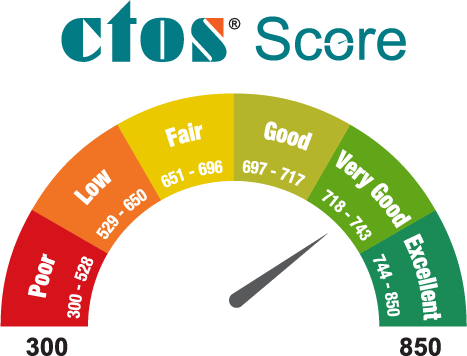

Home Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

How Much Home Loan Can You Get Based On Your Salary In Malaysia

Panduan Cara Blog Ads Networks Web Hosting Domain Murah Cara Buat Duit 2019 Website Percuma Best Online Jobs Honor Mobile Online Jobs

Accomplish Your Study Goals With Student Education Loans Education Student Loan

Buying A Home How Much Am I Able To Borrow Home Buying The Borrowers Home Loans

Property Affordabillity Calculator Home Loan Calculator Cimb

The Future Of Eco Living In Malaysia Ecoliving Globalwarming Enviroment Property Development Info Eco Living Malaysia Eco

7 Mentiras Que Os Bancos Contam E Como Nao Cair Nelas Corporate Bank Opening A Bank Account Best Bank

How Much Home Loan Can You Get Based On Your Salary In Malaysia

Check Your Company New Format Of Ssm Registration Number Trade Insider

Importance Of Personal Loan Loankawala Hyderabad Personal Loans Online Personal Loans Low Interest Personal Loans

How Much Can You Borrow Based On Your Dsr

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Nordstrom Employee Portal Login Help You In Managing Your Payroll Data Employee Login Portal

Applying For A Housing Loan In Malaysia 6 Important Things To Know

How Much Home Loan Can I Get From My Salary In Malaysia Iproperty Com My